Top Payment Gateways for Seamless Online Transactions in 2025

There is one thing that all successful businesses have in common, no matter what industry they’re operating in! This is an “effective payment gateway” that works quietly behind the scenes.

It’s one of those things you don’t really notice, unless something goes wrong! Your payment gateway connects the dots between yourself, the buyer, and the bank, ensuring money moves swiftly and securely. Without it, online shopping would grind to a halt!

When someone places an order online, it’s this gateway that acts as the bridge between your e-store and the financial institutions processing the transaction. While the process may sound simple, it involves highly sensitive data, so you need to protect it. Furthermore, you need to make sure the process doesn’t cause any sort of friction or confusion.

User expectations are only getting higher in eCommerce. People want flexibility, speed, and of course, security. If the payment process feels clunky, slow, or untrustworthy, they’ll walk away, no matter how good your product is.

So, you need to consider getting payments right both a technical decision and a customer experience decision.

From improving conversion rates to enabling global reach, payment gateways play a crucial role in every stage of the buying journey. They give customers the confidence to complete a purchase and give businesses the tools to operate efficiently and securely in a competitive market.

What Is a Payment Gateway?

So, what is a payment gateway and how does it work? A payment gateway is the technology that enables secure and efficient online transactions. It acts as a digital middleman between your eCommerce site and the financial institutions involved in processing the payment.

When a customer enters their payment details during checkout, the payment gateway encrypts and transmits that data to the relevant bank or card provider. Once the payment is approved or declined, the gateway sends the response back to your website, typically within seconds.

Without a gateway, there’s no safe way to transfer payment information between parties. It’s essential for protecting sensitive card details, complying with data security regulations, and reducing fraud.

In simple terms, it does three critical jobs:

- Authorises the transaction — It checks if the customer has enough funds or credit

- Protects data — It uses encryption to keep personal and card details safe

- Connects systems — It bridges the gap between your website, the customer’s bank, and your own merchant account

It’s important to note that a payment gateway for eCommerce isn’t the same as a payment processor or a merchant account. These three work together, but each has its own role in the payment chain. The gateway is the customer-facing component that handles the submission and confirmation of payments in real-time.

It may seem like just another part of your checkout, but in reality, the gateway is one of the most important pieces in creating a reliable and professional online shopping experience.

How Payment Gateways Work

When someone shops online, the process might feel instant; a few clicks and it’s done. But behind those clicks, a lot happens in just a few seconds. The payment gateway is at the centre of it all, coordinating each part of the transaction.

Here’s a simple breakdown of what happens once a customer hits the pay button:

- Customer enters payment details

At checkout, the customer enters their card information or selects an alternative payment method, such as PayPal, digital wallets, or Buy Now Pay Later options. - Data encryption and transfer

The international payment gateway encrypts this information to protect it from unauthorised access. It’s then securely passed on to the payment processor or acquiring bank. - Transaction request

The acquiring bank sends the payment request to the cardholder’s bank (also known as the issuing bank) to verify funds or credit availability. - Authorisation response

The issuing bank either approves or declines the transaction based on the card details, available funds, and fraud checks. That decision is sent back through the same path, from issuer to acquirer, through the gateway, and finally to your website. - Confirmation

If approved, the payment is completed, and a confirmation appears on the website. The funds are then transferred from the customer’s account to the merchant’s account, although settlement may take a few days, depending on the provider. - Order processing begins

With payment cleared, your store can now start fulfilling the order.

Throughout all this, the customer rarely sees what’s going on, and that’s the point. A good gateway payment makes the process feel seamless and stress-free while doing the hard work behind the scenes to ensure security and reliability.

It’s a system that only takes seconds to run, but it’s built on layers of encryption, risk checks, and integrations with banks and card networks, all to make sure every transaction is safe, accurate, and fast.

Key Features to Look for in a Payment Gateway

Not all payment gateway providers are equal. Choosing the right one means understanding which features actually matter, not just from a technical perspective, but also for the customer experience and the long-term growth of your business.

Here are the features that really count.

Security and Compliance

This should be non-negotiable. Look for PCI-DSS compliance, tokenisation, and fraud detection tools. Your customers are trusting you with sensitive information; it’s your responsibility to keep it safe.

Multi-Currency Support

If you’re selling internationally, ensure your gateway can support multiple currencies and payment types. A gateway that only works in one region will limit your reach and frustrate overseas customers.

Speed and Uptime

Payment delays can kill conversions. The best payment gateway will deliver fast processing speeds and high reliability. Even minor downtime during peak periods can result in lost revenue.

Mobile Optimisation

More purchases are being made on phones than ever before. Your payment gateway must be mobile-friendly, with a streamlined checkout that works just as well on small screens as it does on desktop.

Customisable Checkout Experience

A clunky or inconsistent checkout can damage trust. Look for gateways that allow some level of branding or integration so the payment experience feels like part of your website, not a separate platform.

Multiple Payment Options

Today’s shoppers want choice. Your gateway should support credit and debit cards, digital wallets (such as Apple Pay or Google Pay), and alternative payment methods where relevant, especially if your target audience is younger.

Transparent Pricing

No one likes surprise fees. Review the transaction fees, setup charges, and any monthly costs. Make sure the pricing structure is clear and predictable so you can plan ahead.

Easy Integration

Your gateway should work smoothly with your website platform, CMS, and any other tools in your eCommerce stack. The fewer technical headaches, the better.

Strong Customer Support

When something goes wrong (and at some point, it might), responsive and knowledgeable support makes all the difference. Don’t overlook this when comparing providers.

The right payment gateway should align with your business model, scale with your growth, and provide a seamless and secure experience for your customers.

Top Payment Gateways for 2025

The payment gateway space continues to evolve, with new features, better integrations, and stronger security shaping the top players in 2025. While the best option depends on your business model, size, and location, here are some of the most trusted and widely used payment gateways available this year.

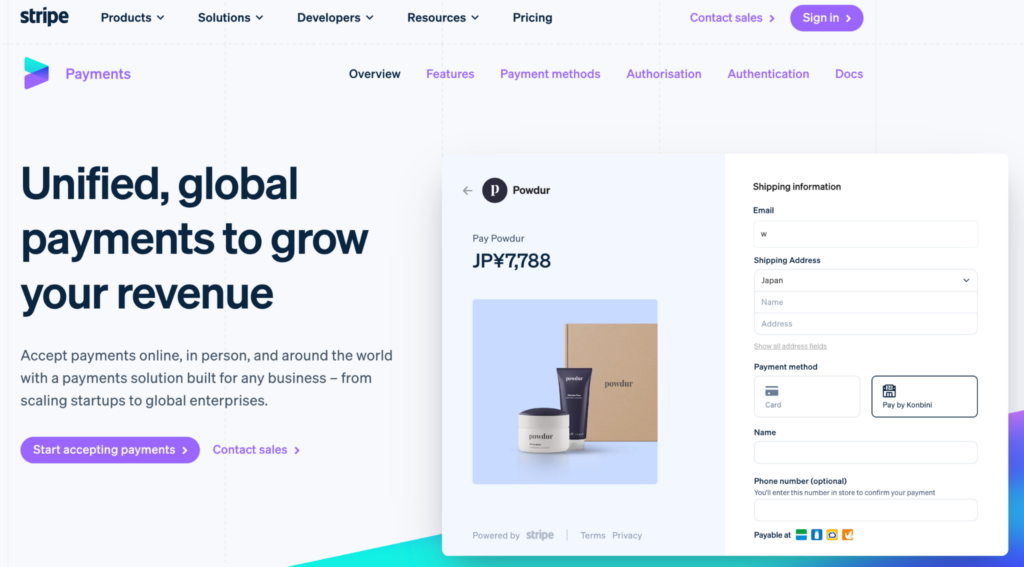

Stripe

Stripe is known for its clean developer tools and customisable checkout experiences. It supports a wide range of payment methods, multi-currency transactions, and subscription billing.

Image Credit: Stripe

Key strengths

- Advanced API and customisation

- Excellent for scaling businesses

- Strong fraud protection and reporting tools

Considerations

- May be more technical to set up for non-developers

- Fees can add up for smaller merchants

PayPal

A familiar name to both businesses and consumers, PayPal remains a widely trusted payment gateway. It offers one-touch payments, buyer protection, and is easy to integrate with most platforms.

Key strengths

- High consumer trust and recognition

- Simple setup

- Accepts payments from a large number of countries

Considerations

- Higher fees than some alternatives

- Checkout can redirect customers off-site unless customised

Adyen

Popular with larger businesses and global brands, Adyen supports a huge variety of payment methods and offers an all-in-one platform that includes a gateway, processing, and risk management.

Key strengths

- Unified system across markets

- Enterprise-grade reporting and insights

- High reliability and uptime

Considerations

- Not ideal for small businesses

- Requires some technical setup

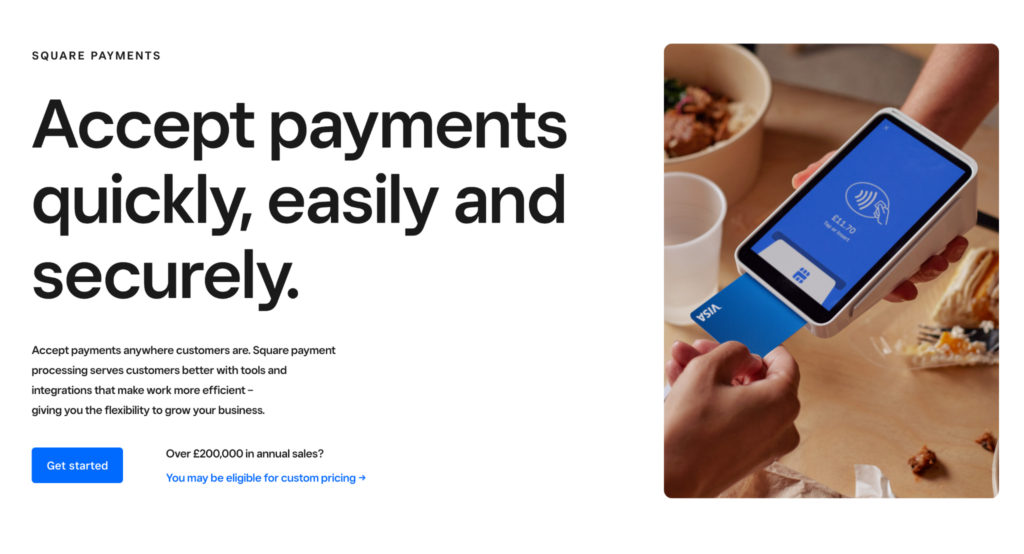

Square

Square offers more than just a payment gateway; it’s a comprehensive payment solution that includes hardware, point-of-sale (POS) systems, and online tools. It is particularly well-suited for retailers and small businesses that operate both online and in-person sales.

Image Credit: Square

Key strengths

- Seamless integration between online and physical stores

- Simple pricing model

- Easy to use

Considerations

- Limited features for global payments

- Not ideal for high-volume international businesses

Checkout.com

Checkout.com has grown quickly due to its customisable platform and support for global payment methods. It is especially strong in areas such as fraud management and data control.

Key strengths

- Multi-currency and global support

- Modern, flexible APIs

- Scalable for fast-growing businesses

Considerations

- More tailored to mid-sized to large companies

- Setup may require developer resources

Each gateway comes with its own strengths, fees, and technical requirements, so it’s essential to compare them carefully based on your business’s current needs and future direction.

How to Choose the Right Payment Gateway for Your Business

With so many options out there, it’s easy to feel overwhelmed. But choosing the right payment gateway isn’t about picking the biggest name; it’s about finding the best fit for your business and your customers.

Here are a few key things to think about when making your decision.

Know your audience

Start with your customers.

Where are they based?

What payment methods do they prefer?

If you’re selling internationally, you’ll need a gateway that supports multiple currencies and local payment types. If your audience leans mobile-first, mobile optimisation is a must.

Look at your business model

If you sell physical products, your needs may differ from those of a subscription-based service or a digital product business. Some gateways handle recurring billing better than others. Make sure the gateway supports your sales structure and checkout flow.

Factor in your budget

Every gateway charges fees, which are typically a percentage of each transaction, sometimes accompanied by additional monthly charges. Review the pricing structure carefully and determine how it aligns with your margins.

Watch out for hidden costs, such as chargeback fees or additional charges for specific card types.

Check integration options

Ensure the gateway is compatible with your website platform, whether you’re using a custom build or a hosted solution. The easier the integration, the less time and money you’ll spend on setup and troubleshooting.

Think about scalability

It’s not just about what works now. You need to think ahead.

Will your chosen gateway be able to handle an increased number of transactions as you grow?

Can it support new features you might need later, such as global expansion or one-click checkout?

Prioritise support and reliability

Payment issues affect your bottom line. Choose a provider that is known for its uptime and responsive support. If something goes wrong during a busy sales period, you’ll want fast help from someone who knows what they’re doing.

Consider customer trust

The checkout is where trust is either confirmed or broken. A secure, seamless payment experience reassures customers and reduces drop-off.

Choose a gateway that prioritises user experience, and you’ll notice an improvement in your conversion rates.

Emerging Trends in Payment Gateways for 2025

Payment technology is moving fast, and staying ahead of the curve can give your business a serious advantage. In 2025, the way people pay online is being reshaped by innovation, consumer behaviour, and growing expectations around convenience and security.

1. Growing Demand for Alternative Payment Methods

Credit and debit cards are no longer enough. Customers now expect to use digital wallets, Buy Now Pay Later (BNPL), direct bank transfers, and even cryptocurrencies on some platforms.

The best payment gateways are adding support for these options to keep up with demand and prevent checkout drop-offs.

2. Rise of 1-Click Checkout

Speed is everything, especially on mobile. The concept of 1-Click Checkout is becoming standard, allowing returning customers to complete a purchase instantly, without re-entering details.

It reduces friction, shortens the buying process, and improves conversion rates across the board.

3. Embedded Payments and API-First Platforms

Rather than using standalone systems, businesses are increasingly turning to gateways that offer embedded payment solutions, i.e., seamless payment flows built directly into the user experience.

These API-first gateways give developers full control over how and where payments occur, without interrupting the design or user journey.

4. Enhanced Fraud Detection with Machine Learning

Security remains a top priority, and payment gateways are investing heavily in smarter fraud prevention tools.

Machine learning algorithms are now analysing behaviour in real time, flagging unusual activity, spotting patterns, and adapting to new threats faster than ever before.

5. Focus on Payment Experience as a Differentiator

Customers no longer see payment as just a formality. They expect fast load times, flexible payment options, and zero frustration.

As a result, payment gateways are focusing on user experience; streamlining flows, reducing redirects, and offering better mobile support.

6. Increased Regulation and Compliance Requirements

With tightening global data regulations, particularly around consumer privacy and cross-border payments, gateways are being forced to adapt.

Compliance is becoming a selling point, not just a checkbox. Businesses need providers that stay up to date with evolving legal requirements in different markets.

7. Greater Integration with eCommerce Platforms

Gateways are making it easier than ever to plug into popular eCommerce platforms without heavy development work. This trend is especially beneficial for smaller businesses and start-ups, as it reduces setup costs and technical barriers.

These trends all point to the same thing: customers want fast, simple, and secure payments, wherever they are. Businesses need to offer that if they want to stay competitive.

Make Payments Effortless and Customers Will Keep Coming Back

A fast, secure, and user-friendly checkout experience is part of your brand’s overall value. Also, optimize for mobile commerce is thriving at the moment.

Payment gateways play a major role in how customers perceive your business. A smooth process builds trust. Friction or errors create doubt. And in a competitive space like eCommerce, trust is everything.

The right gateway can increase conversion rates, reduce abandoned baskets, and open your store to global markets. But more importantly, it can help turn one-time buyers into loyal, returning customers.

If you want to stand out, you need a gateway that works for your business model, your audience, and your growth plans. And that’s where expert guidance makes all the difference. Working with a trusted eCommerce agency like Appnova can help you build a payment experience that’s optimised not just for today, but for the future.

Whether you’re starting fresh or upgrading your current setup, the right tools will help you go further, faster, and more confidently. So, why not give us a call today to get started?

Frequently Asked Questions

How can I add a payment gateway to my website?

Most eCommerce platforms offer built-in integrations with popular payment gateways. You’ll typically need to:

- Set up a merchant account with your chosen gateway provider

- Connect the gateway to your website via plugin, API, or built-in settings

- Configure accepted payment methods, currencies, and checkout settings

- Test the checkout process before going live

If your website is custom-built, you may need developer support to ensure proper integration and full security compliance.

Can I create my own payment gateway?

Technically, yes, but it’s complex, expensive, and time-consuming. You would need to meet strict security regulations, obtain PCI-DSS certification, establish connections with banks and card networks, and develop a secure processing infrastructure.

For most businesses, it is far more practical and cost-effective to use an existing payment gateway provider rather than building one from scratch.

Which payment gateway has the lowest transaction fees?

Fees vary depending on the provider, your business size, and the regions in which you sell. Generally, providers like Stripe, PayPal, and Square have transparent per-transaction fees, but lower-cost options may be available through local or region-specific providers.

Keep in mind that the lowest fees aren’t always the best. Consider other factors, such as support, reliability, and features, as hidden costs or lost sales due to a poor user experience can outweigh fee savings.

What is the best payment gateway for international businesses?

If you’re selling across borders, look for an international payment gateway that supports:

- Multi-currency transactions

- Local payment methods (beyond just credit cards)

- Fraud protection with global risk settings

- Language and localisation features for different markets

Gateways like Stripe, Adyen, and Checkout.com are known for strong international capabilities, but the best fit will depend on your target markets and specific needs.

Subscribe To Us

Our Services

Categories

Subscribe To Us

Contributors

Categories

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Third party cookies such as Google Analytics is also used on this site to provide analytics in order to better understand the user engagement on our site.

You can adjust all of your cookie settings by navigating the tabs on the left hand side.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

0.Comments